Are 401(k) Contributions Based on Pay Period or Pay Date?

As an employee, understanding how and when your 401(k) contributions are deducted can impact your financial planning. Many wonder whether these contributions are based on their pay period or pay date. This article will delve into this topic, providing a comprehensive overview and expert insights to enhance your knowledge.

When it comes to 401(k) contributions, both the pay period and pay date play crucial roles. However, the exact timing of the deduction can vary depending on factors such as the payroll processing system and the specific rules established by your employer’s plan.

Pay Period vs. Pay Date

The pay period refers to the period of time over which your earnings are calculated. Common pay periods include weekly, bi-weekly (every two weeks), semi-monthly (twice a month), or monthly. Your pay date is the specific day on which you receive your paycheck or have the funds electronically deposited into your account.

401(k) Contribution Timing

In general, 401(k) contributions are deducted from your paycheck on the pay date. However, the specific timing of the deduction can vary. Some employers may deduct the contribution on the first pay date following the end of the pay period, while others may deduct it on the last pay date within the pay period. It’s important to check with your employer or plan administrator to determine the exact timing for your specific situation.

For instance, if you have a bi-weekly pay period that ends on a Friday and a pay date on the following Wednesday, your 401(k) contribution may be deducted on that Wednesday. Alternatively, if your employer deducts contributions on the last pay date within the pay period, the contribution may be deducted on the Friday before the end of the pay period.

Payroll Processing Considerations

The payroll processing system used by your employer can also affect the timing of your 401(k) contribution. Some systems may deduct the contribution before taxes are withheld, while others may deduct it after taxes. Additionally, some systems may allow you to adjust the timing of your contribution, such as by setting up a specific deduction date.

Matching Contributions

If your employer offers matching contributions to your 401(k), the timing of the contribution can be different from your own contributions. Typically, matching contributions are made on a monthly basis, regardless of your pay period or pay date. This is because matching contributions are based on your total earnings for the month, not just the earnings within a specific pay period.

Tips and Expert Advice

- Check with Your Employer: The best way to determine the exact timing of your 401(k) contributions is to check with your employer or plan administrator. They can provide you with specific information regarding your plan’s rules and the timing of deductions.

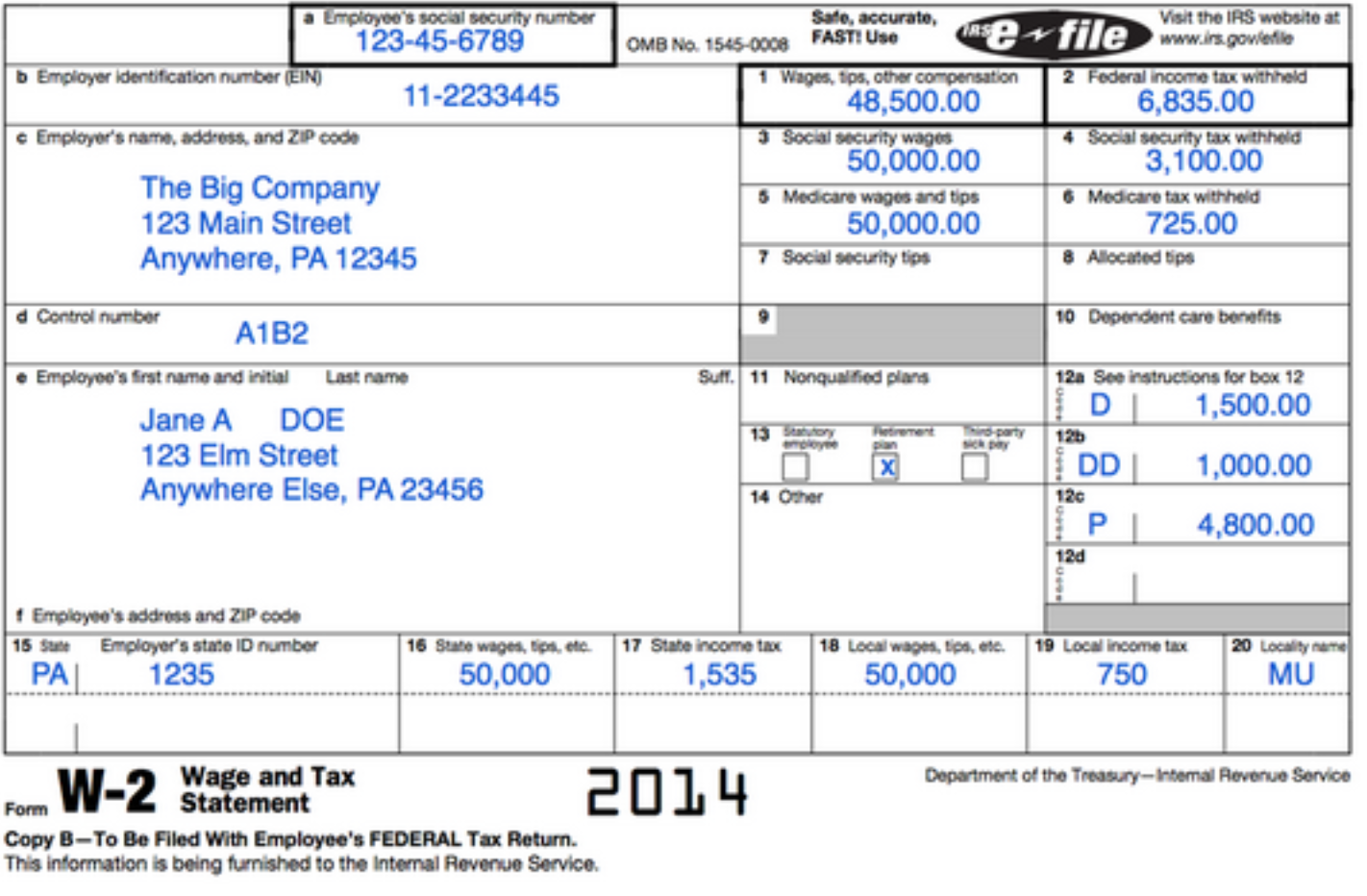

- Review Your Pay Stub: Your pay stub should indicate the amount of your 401(k) contribution and the date on which it was deducted. This can help you track the timing and ensure that contributions are being made as expected.

- Consider Your Financial Goals: When determining how much to contribute to your 401(k), consider your financial goals and risk tolerance. It may be beneficial to consult with a financial advisor to determine the optimal contribution amount for your specific situation.

FAQs

Q: Can I change the timing of my 401(k) contributions?

A: In some cases, you may be able to adjust the timing of your contributions. Contact your employer or plan administrator to inquire about the options available.

Q: What happens if my employer makes a late 401(k) contribution?

A: If your employer makes a late contribution, they may be subject to penalties and reporting requirements. It’s important to follow up with your employer if you believe a contribution was not made or was made late.

Q: How does the timing of 401(k) contributions affect my taxes?

A: 401(k) contributions are made on a pre-tax basis, meaning they are deducted from your paycheck before taxes are withheld. This can reduce your current taxable income and potentially lower your tax bill.

Conclusion

Understanding the timing of your 401(k) contributions is essential for effective financial planning. Whether contributions are based on your pay period or pay date can vary depending on your employer’s plan rules and payroll processing system. By checking with your employer, reviewing your pay stub, and consulting with a financial advisor, you can ensure that your contributions are being made in a way that meets your financial goals.

Are you interested in learning more about 401(k) contributions and financial planning? Check out our other articles and resources for valuable insights and expert advice.

Source Image: www.financialsamurai.com

Source Image: www.financialsamurai.com

Source Image: www.financialsamurai.com

Thanks for your dynamic approach to delving into this material. Are 401k Contributions Based On Pay Period Or Pay Date, is a fantastic resource for deepening your insight.