Discover various interesting information about Do I Need An Llc For My Notary Business, all of which we’ve summarized from various reliable sources.

Do You Need an LLC for Your Notary Business?

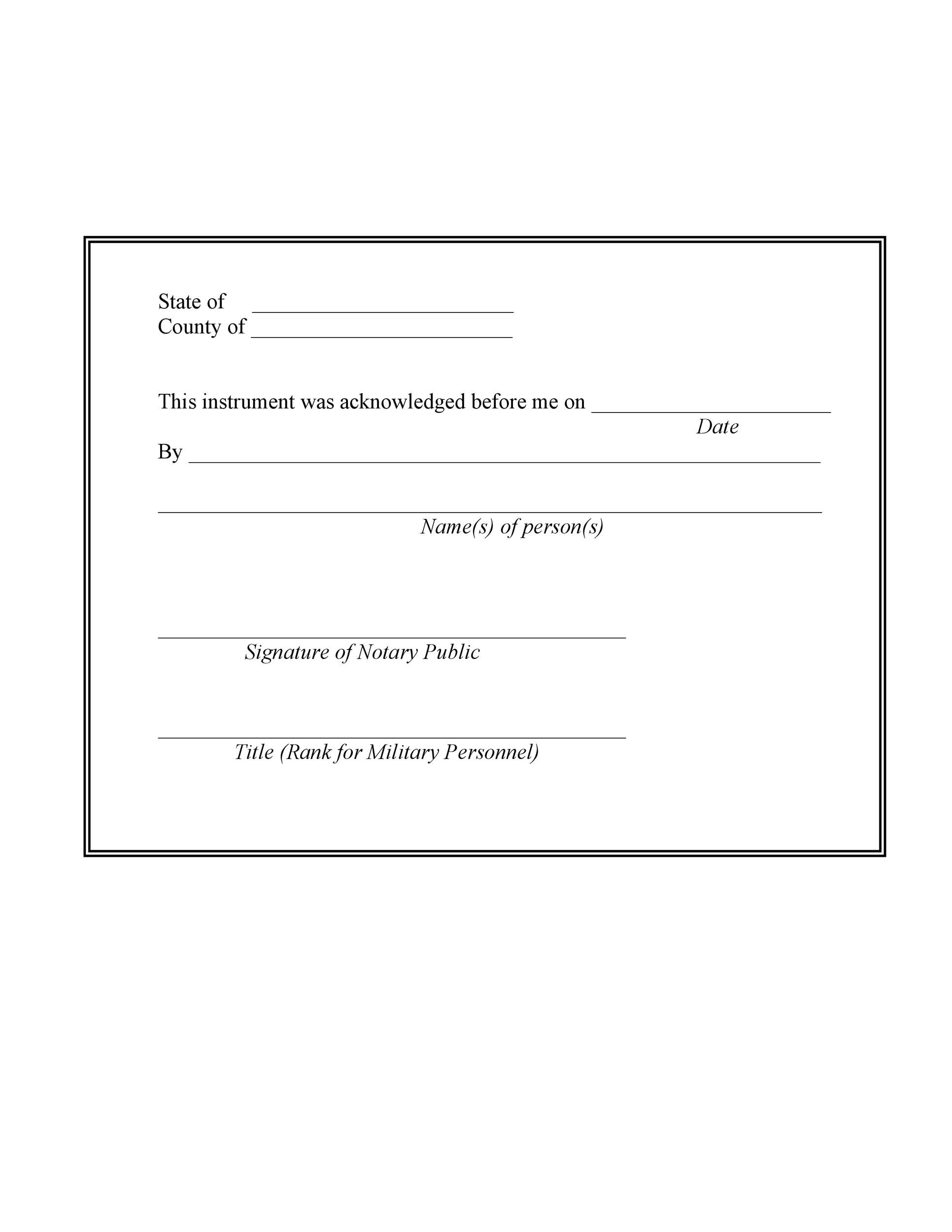

As a notary public, you’re often called upon to notarize documents for people in your community. While this is a relatively simple task, it’s important to make sure you’re doing it correctly. One way to do this is to form a limited liability company (LLC). An LLC can protect you from personal liability if someone sues you for something that happens while you’re notarizing documents.

There are many benefits to forming an LLC for your notary business. In addition to protecting you from personal liability, an LLC can also help you save money on taxes and give you more flexibility in how you run your business. If you’re thinking about starting a notary business, or if you’re already a notary public who wants to protect yourself from liability, forming an LLC is a smart move.

What is an LLC?

An LLC is a type of business entity that combines the features of a corporation and a partnership. LLCs are popular because they offer limited liability protection to their owners, which means that the owners are not personally liable for the debts and liabilities of the LLC. This means that if someone sues your notary business, your personal assets (such as your home, car, and savings) will be protected.

LLCs also offer a number of other benefits, including:

- Pass-through taxation: LLCs are not taxed as separate entities, which means that the profits and losses of the LLC pass through to the owners and are reported on their personal tax returns.

- Management flexibility: LLCs can be managed by their owners or by a board of managers. This gives you the flexibility to choose the management structure that best suits your needs.

- Tax savings: LLCs can save you money on taxes compared to other types of business entities, such as corporations.

Do I Need an LLC for My Notary Business?

Whether or not you need an LLC for your notary business depends on a number of factors, including the size of your business, the number of clients you have, and the amount of risk you’re willing to take. If you’re just starting out and you don’t have many clients, you may not need to form an LLC. However, if you’re a notary public who is regularly notarizing documents for clients, you should consider forming an LLC to protect yourself from liability.

Here are some of the benefits of forming an LLC for your notary business:

- Protection from personal liability: An LLC can protect you from personal liability if someone sues you for something that happens while you’re notarizing documents.

- Tax savings: LLCs can save you money on taxes compared to other types of business entities, such as corporations.

- Increased credibility: An LLC can give your notary business a more credible and professional appearance.

- Flexibility: LLCs offer a number of management and operational flexibilities that can be beneficial for notary businesses.

How to Form an LLC

Forming an LLC is relatively simple and inexpensive. You can do it yourself online or through a lawyer. If you’re doing it yourself, you’ll need to file a Certificate of Formation with your state’s Secretary of State. The Certificate of Formation will contain basic information about your LLC, such as its name, address, and purpose.

Once you’ve filed your Certificate of Formation, you’ll need to obtain an Employer Identification Number (EIN) from the IRS. The EIN is a unique number that identifies your LLC for tax purposes. You’ll need the EIN to open a bank account for your LLC and to file your taxes.

Tips for Forming an LLC

Here are a few tips for forming an LLC for your notary business:

- Choose a name for your LLC that is easy to remember and reflects the nature of your business.

- File your Certificate of Formation with your state’s Secretary of State as soon as possible.

- Obtain an Employer Identification Number (EIN) from the IRS.

- Open a bank account for your LLC.

- Keep your business and personal finances separate.

- File your taxes on time.

FAQs About LLCs for Notary Businesses

Here are some of the most frequently asked questions about LLCs for notary businesses:

- Do I need to have a business license to operate an LLC notary business?

- Do I need to file taxes for my LLC notary business?

- Can I use my personal bank account for my LLC notary business?

Yes, you will need to have a business license to operate an LLC notary business. The requirements for obtaining a business license vary from state to state, so you should check with your local government to find out what is required in your area.

Yes, you will need to file taxes for your LLC notary business. LLCs are pass-through entities, which means that the profits and losses of the LLC pass through to the owners and are reported on their personal tax returns.

No, you should not use your personal bank account for your LLC notary business. It is important to keep your business and personal finances separate. You should open a separate bank account for your LLC and use it for all business transactions.

Conclusion

Forming an LLC for your notary business is a smart move that can protect you from personal liability, save you money on taxes, and give you more flexibility in how you run your business. If you’re thinking about starting a notary business, or if you’re already a notary public who wants to protect yourself from liability, forming an LLC is a great option.

Are you interested in learning more about LLCs for notary businesses? Let me know in the comments below, and I’ll be happy to provide you with additional information.

Image: gonotarysd.blogspot.com

Thank you for reading Do I Need An Llc For My Notary Business on our site. We hope you find this article beneficial.